As we discussed in Part One of our The Effects of FX series, the most important factor in determining currency exchange rates – which are at the heart of global capital flows – are the interest rates set by the world’s central banks. 1<- – – Click this little footnote.

And for over five years the US has maintained a “zero interest rate policy” (or “ZIRP”),2 which has had a profound effect on almost every capital market around the world. Equities, bonds, commodities, etc… all have been affected by the massive easing program led by the world’s largest economy.3

So to recap what you probably already know, as the world moved beyond the damage of the financial crisis and recovery began in 2009, the dominant theme was “the search for yield.” Capital fled the U.S. (and Europe) and the weak returns offered by our ZIRP for better paying countries and markets. Because as we stated in Part One… Capital will go where it is treated best.4

The effects of multi-year ZIRP.

Well, the effects of our little ZIRP experiment on global capital flows were quite powerful. As money poured into these emerging and frontier markets in which interest rates – and return on invested capital – were much higher, those currencies (and the respective equity/bond markets) soared. And so for several years EM/FM was the place to be.

As an illustration, here’s a chart of the most popular Emerging Market ETF (ticker: EEM) from 2009 to present:

As you can see from the chart above, most of this gain in emerging markets took place during 2009-2011 (notation “A). And then things leveled off (notation “B”) as this buy-buy-buy-EM theme was re-evaluated, leaving many EM/FM markets trading sideways for the past few years.

You see, it started to become clear to investors over the past couple of years that the massive quantitative easing (“QE”) and ZIRP policies of “The West” were resulting in the recovery of economic growth in the U.S. This meant that EM/FM wasn’t the only cool kid on the block anymore. The excitement spread to other more developed markets as it was becoming clear that developed economies were participating in the recovery.

And so the consensus for the last couple of years has basically been “QE and ZIRP worked! We are saved!” And for all practical purposes we were. Investors in most markets were rewarded for their faith (and capital). Stocks and bonds – both in the U.S. and in emerging markets – as well as just about any other asset class (i.e. fine art, wine, luxury homes). Just name a market, it was probably up over the past five years.

It’s getting late. Last call. Stop the music.

And then, as we’ve spoken about in the “how we saved 20%” teaser intro to this series, about a year ago the U.S. Dollar started to rise. The Fed had already ended its QE program and was no longer buying $85 billion per month of bonds. And with the economy moving along, the risk of deflation all but gone, and unemployment falling back to acceptable levels, investors now shifted their attention forward in anticipation of an eventual rate hike.

As we said in the last section… interest rates are extremely important to exchange rates and, as you all likely know by now, the markets are always looking ahead to price in future events. And so even though most expected the Fed’s first hike to be a year or so away, the rise in the Dollar started last summer. And it did so somewhat quietly.

For the second half of 2014, this rise in the Dollar went largely unnoticed by most “non-professional” investors. If you owned a basket of mutual funds or even individual stocks and bonds, you probably will recall headline after headline of “Dow makes a new high,” or “S&P 500 breaks records.” Very few noticed that this rise in the Dollar would, of course, mean that somewhere… far away… someone else’s currency was falling. 5

But then by early 2015… more and more media sources – and not only the financial media – began to carry stories about the strength of the Dollar and, more importantly, the weakness in many emerging and frontier market currencies.

But don’t worry if you do not recall reading about this or didn’t even realize it was happening. Because there was a key bit of “noise” out there which made it hard to notice. And that is, of course… heavy sigh… the always-about-to-default basket case that is Greece. As a result of the Greek tragedy taking place6, the Euro was one of the worst hit currencies and fell went into a nose dive from $1.40 to $1.05 over the last year.

With most headlines focusing on Greece and the Euro, it was hard to notice that a sell off was beginning to gain steam in other emerging and frontier markets and currencies .

In addition to the strength of the U.S. Dollar,7 another macro-economic event was happening. One that I’m positive all of my readers will recall.

And…. that would be the plunge in oil prices.

As oil prices fell from over $100 per barrel in mid-2014 to now under $40 per barrel… the currencies and economies that are major oil exporters got – how to put this delicately – taken out to the woodshed and beaten. By six large dudes. With sledgehammers. 8

So. Let’s recap.

Between the collapse in oil, the drama in Europe, and the euphoria of many western markets making all time highs… the bloodbath in emerging and frontier went largely unnoticed.

Ok, party is over. Everyone please go home.

But then… China decided to devalue the Yuan.

Waaaaay too much to cover here and I have some strong thoughts about the whole thing, so I’ll just say 1) in the short run it was clever and will help them, but 2) over the long run the Yuan needs to strengthen against the Dollar, not weaken, as I wrote about in this post.

So moving on… the recent devaluation by China didn’t start this crazy sell-off, it just brought the currency issue to the front page. From talk of currency wars to hype about a repeat of the ’97 Asian financial crisis, the media is now fixated on this.

So where does that leave us? Time to panic? Sell everything? 9

Um, no. Or at least it shouldn’t be time to panic. But for some…. it’s too late for that.

Because as I write this at 4:30 pm Poland time – or 9:30 am NY time – I just got this lovely email from CNBC:

Ah, CNBC. **Heavy Sigh** Where another “The world in crisis” special is always right around the corner.

So listen carefully. Ignore CNBC.10 They sell fear.

I actually think this could be an excellent opportunity.

Why this could be an excellent opportunity.

Ok. Two points to make here.

Point #1: We should stop measuring this emerging market sell-off from the peak.

We should stop saying “oh-my-gawd Brazil is down how much?” Or “China is off X percent from the highs!” Extreme-ism like that does not help anyone.

What do I mean by that exactly? I mean headlines like this from reputable news sources like the WSJ.

China Shares Wipe Out All Gains This Year.

Sure… It’s not a lie. Yeah, that happened – the sell off did wipe out the year-to-date gains. But over the past year (as in 52 weeks, not year-to-date) the Shanghai index is still up over 45%! 11

See:

Of course they don’t show this chart. “China is only up 46% now” won’t sell as many papers.

Not that terrible of a chart when you look at it on a one year basis, right? So we just have to get past the “fear” headlines. Instead of “year-to-date gains wiped out” we should be thinking “the SSEC went up from 2200 to 5200, and is down to 3500.” Or something like that.12

So what if there is a sell-off in many of the emerging and frontier markets? I actually think of this sell-off as the end of the capital-chasing-yield bubble. The “we have to invest outside of the US to get a decent return” bubble is finally popping.

Because as we’ve (hopefully) explained in this series, much of that money that is now coming out of those markets… well, that money had no business being there in the first place. It was just “hot money” looking for yield. It was bubble money. And so now that a U.S. rate hike appears to be nearing, that capital doesn’t need to go abroad for that yield anymore so it is leaving those EM/FM markets.

To which I say “good riddance, Sir!”13

You see, there are several emerging & frontier markets that we like for their long-term potential. Young and educated populations, low debt, and strong economic growth = bright futures.14 I want to own those markets over the long run. But the thing is – or, er, was – is that those markets have been way way15 up over the past few years, so we’ve been patiently waiting for valuations to come down. Waiting, patiently, for all that “hot money” to leave. So that we can buy them at a discount.16

And so that’s the end of my first point. We don’t care that those markets (and currencies) are selling off. Our burgeoning fund, BGIP, has been sitting on a lot of cash waiting for this buying opportunity.

Point #2: The Fed isn’t going to be off-to-the-races anyway.

To be fair, I have no idea if the bottom in emerging markets and currencies is now, near, or even getting close. But it is clear to me that the main reason for the sell-off in these markets is a direct result of the strong Dollar.

And as we’ve talked about17 in this post… that strong Dollar causing the sell-off is a result of the pending Fed rate hike(s) that everyone is so focused on.

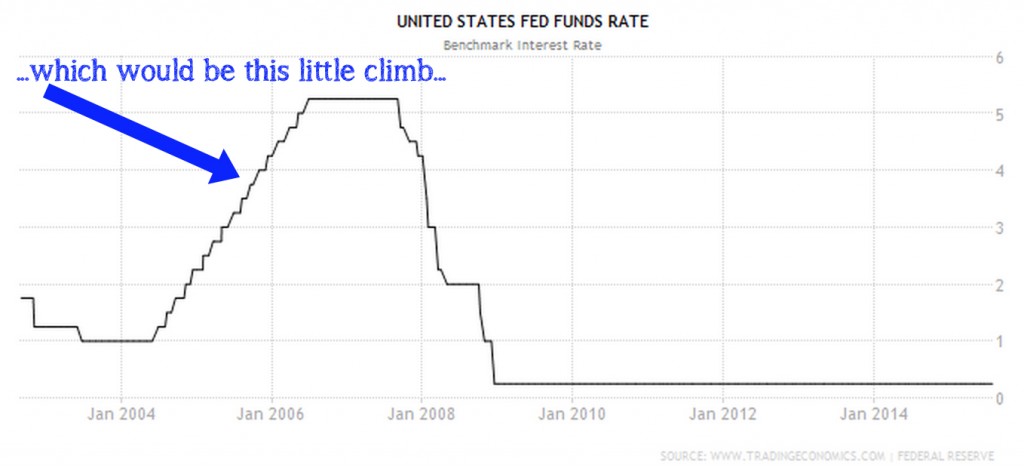

So I’d like to quickly offer my theory on why the markets are over-reacting to a rate hike. Starting with a look at the Fed’s last rate hike cycle:

See – A nice, smooth, pretty step-by-step climb in rates.

Said differently, from a 1% starting point in 2004:

- Starting in June 2004 the Fed hiked 5 times that year,

- then hiked another 8 times in 2005,

- and then 4 more times in 2006 to end at 5.25%

So that is a pretty steady – and very importantly – predictable climb. Once it started raising rates, the Fed kept going at a nice, steady, predictable pace. And that’s the thing… generally speaking, when a country’s central bank starts a hiking (or easing) cycle, it typically keeps going for a while.

And now… for the five most dangerous words in finance:

This time will be different.

Think about the US economy today versus the start of that hiking cycle in 2004. I’m not going to spend that much time on it here because 1) there is too much to say about why this US economy is so much more fragile and 2) I’ve been working on this post for five hours now.

My point is that I strongly strongly 18 believe that it doesn’t matter if the Fed raises by 0.25 or 0.50 bps at the next meeting in September. 19

I believe that the US recovery is still too fragile to begin a prolonged series of hikes that takes us anywhere close to 5%. So we can all stop worrying about a Fed rate-hiking party.20

What I am going to do about it.

Ok, so if I’ve said that 1) the money fleeing the EM/FM markets is just fine with me so that I can buy those markets at a discount and 2) that money is over-reacting anyway if it thinks this is 2004 and we’re headed for a straight march to a 5% Fed Funds Rate…. what does that mean? 21

Well, as we’ve said in this series… interest rates are the most important factors in currency movements and those interest rates drive capital flows. And so… if we don’t think that the Fed will be engaging in a long-term hiking cycle, my belief is that this run in the Dollar is nearing an end.22

And my job now isn’t to worry about what is going to happen today. Or this week. Or even for the rest of the year, honestly. I need to try and live in the future. To see what the markets will look like in 2018. Or 2020.

And I think that in that 5-years-out future, we will all still live in an environment of low interest rates.

Maybe not zero percent. But certainly not five percent. Instead, maybe the Fed tests the waters and gets away from zero just so that it can say it has moved past the “emergency” measures enacted during the financial crisis. 23

But it certainly won’t be off to the races. So all the Dollar bulls need to calm down. You’ve had a good run. Don’t push it.

So that means I’m ready to put some capital to work. I want to buy some of these beaten down emerging and frontier markets. I want to own their stocks. And in some cases their bonds. And… I really like some of their currencies. 24

I have no idea if this is “the” top in the US Dollar. But there is one thing I’m sure of. There are some discounts out there. I look at what is going on with the currencies and markets in Nigeria. In Malaysia. In Colombia. And in several others.

And I can’t help but think that it doesn’t matter whether or not this is the exact bottom for those markets and currencies. The fundamentals are solid. Their economic growth prospects are real. And their future is bright.

So it is time to step in and to buy today’s “fear” for the sake of tomorrow’s long-term opportunity.

Thanks for reading,

Christopher

(Note: Rather than drag out this post, a separate one taking a nerdy look at some markets we are looking at – and buying now – will follow shortly.) (Update: that post is here)

Position Disclosure: Long EUR.USD and short USD.NOK at the time of writing, both in BGIP and in personal retirement accounts.

The BackpackInvesting.com & BGIP Disclaimer

All market commentary and any other financial references featured on BackpackInvesting.com represent the opinion of the author and are not be construed as investment or trading advice. Such articles and commentary are not meant to be a solicitation or recommendation to buy, sell, or hold any securities mentioned. In the event that the author has an interest in any security, currency, or other financial instrument or product mentioned, that position will be disclosed at the time of writing, both for the accounts of Brentwood Global Investment Partners, LP (“BGIP”) and for the author’s personal accounts.

These little boxes are where I try to explain something in more detail in case it’s new to the reader. Other times I’ll just try to make a funny comment. You’ll just have to click to know which… ↩

No, I didn’t make up ZIRP because I don’t want to type out zero interest rate policy. It’s actually called that by the entire nerd community. ↩

that would be ‘Murica in case there was any confusion. ↩

Said differently, why would an investor park capital in a bond paying < 1% in the U.S. when a similar duration bond in Brazil or Indonesia might pay 7%? ↩

…but not ours, so of course we didn’t care. ↩

I know, boooooo, bad joke. ↩

…as a result of investors bringing capital back to US Dollar denominated assets in anticipation of higher rates… ↩

…and just for good measure. The beating oil took ended with this finishing move. ↩

Buy gold, spam, and bottled water? ↩

Oh, not just right now. I mean basically always. ↩

… one more “!” just for good measure. ↩

Moving on. ↩

… or Madame, of course. ↩

…And if I can ever get caught up on blogging we’ll be taking a closer look at several of them.↩

way ↩

…or at least at fair value. ↩

ad nauseum… ↩

strongly ↩

But for the record, I don’t think they hike in 2015. ↩

Ok, I said above “too much to go into” but here’s one little rant: If the Fed does start soon and continues with a series of hikes, it could send the US Dollar even higher, which would present even more problems for emerging markets. Not to mention the US companies that are already complaining about the strong Dollar hurting exports or the multi-nationals that won’t repatriate profits into a strong Dollar environment. Remember… S&P 500 companies generate over 45% of revenue overseas. Moving on. ↩

“No one knows what that means… but it’s provocative. It gets the people going…” ↩

…if not over already.↩

Remember… even a rate of 1% or 2% is still “accommodative” Fed policy… ↩