Note: I had this post mostly done a week ago, but kept tinkering with it, so the charts are a week old. But haven’t changed much.

—————

Let’s jump right into it, shall we? Market volatility the past few weeks has been a little nuts. China. The Fed. Oil. Malaysia. ECB QE. The Dollar. Pick your poison.

Two weeks ago we even had CNBC running their about-once-per-year “The World in Crisis” specials (like this or this or this). So it has clearly been a little wild out there.

So what’s the deal?

Well. We just so happen to be sitting on the cusp of a major shift in the global macroeconomic landscape. THE dominant theme in the markets over the past seven years has been US monetary policy. We led the world with quantitative easing and zero rates. Hashtag easy money. But that system is coming to an end.

With the Fed’s “QE3” program now a year in the rearview mirror, the last remaining piece of post-crisis easing is our zero percent interest rate policy. And now… that too appears to be ending.

Which begs the question… where do we go from here? 1<- – – Click this little footnote.

All eyes on the Fed.

Unfortunately for the non-nerds in the room, almost all market talk as of late revolves around the US Federal Reserve. Specifically… it revolves around this week’s Fed meeting on September 16-17. A “will they” or “won’t they” debate now rages in the financial media and you can hardly read a single market-related article without some reference to whether or not the Fed will raise interest rates for the first time in nine years.

Recall that the Fed has a dual mandate; its job is to promote “maximum employment” and to ensure “stable prices.” Said differently… jobs and inflation.2

On the jobs front, the picture is pretty clear. The US labor market has drastically improved during the post-crisis period, with unemployment falling to 5.1% on the most recent Employment Report.3 That level of unemployment is right in line with the Fed’s target, so on the jobs front… the data points to a rate hike.

The inflation goal of the Fed’s mandate is, well, less clear. There are a ton of different economic reports that monitor inflation in a variety of ways. 4 And the Fed uses a lot of these measures to try and forecast when and if inflation will hit their target – which is basically 2% inflation.5 However, we don’t quite seem to be getting to that 2% level.

First, the crash in oil and other commodity prices over the past year greatly lowered inflation expectations. Secondly, a slower recovery in Europe and questions about the strength of China’s export-heavy economy have prevented inflation fears from creeping back into the global-trade conversation. And lastly – and very recently – general market turmoil tends to hurt consumer confidence, which can dampen consumer spending, which also lowers inflation pressures. Last Friday the latest consumer confidence numbers came in at 85.7. Analysts were expecting 91.4. So that’s a miss… and it prompted a barrage of Fed articles like this.

So to summarize the Fed’s two mandates: on the employment front we have a green light. But on the issue of inflation we probably have a yellow light. Or a blinking red. Or something like that.

Confused yet? You should be.

At this point the financial media is basically – no, literally – calling it a coin toss.

But it shouldn’t be. A “coin toss” by definition is just a guess with 50/50 odds. A policy move by the central bank of the world’s largest economy should NOT be a coin toss. It should be a… well… something more predictable and clearly communicated.

So I guess my point is that 1) everyone is confused and 2) the Fed should work on clearing up communication. They should at least just reassure the markets that they won’t do anything stupid.

I’d maybe even suggest incorporating a little humor just to lighten the mood out there. So if any Fed officials are reading this… I’ve drafted a statement that is ready to go at the end of your September 16-17 meeting. Here’s a copy ready for immediate release.6

Anyway. Let’s move past the “September argument.” Whether or not the Fed decides to hike at this next meeting… the message from the Fed is clear: We should be ready to say goodbye to 0%.

It will be mistake to hike right now.

The debate over the Fed’s first rate hike seems to only be focused on the employment and inflations issues here in the US. Not only are there countless articles and opinion pieces debating whether or not employment and inflation in the US justify a hike, but there are plenty of articles explaining that the Fed has been given the green light from the bond market (like this one and this one).

So while it is great that the US bond market isn’t freaking out right now,7 just because the fixed income market is pricing in a slow and predictable period of rising rates does not mean that is the only risk. The main risk that I see at this point is not that rising rates could potentially hurt US treasury and corporate fixed income markets, but rather the effect that rising rates in the US could have on the US Dollar going forward. I’m worried about the issues that have already started to affect EM and FM currencies and markets causing broader contagion.

The world is not ready for an even-stronger-than-the-already-strong Dollar. The effects of a rising dollar have already been rough. As just one example… there was a huge spike in Dollar-denominated debt issued in emerging markets over the past seven years – it is now $9 trillion Dollars. As that article highlights, that is $3 trillion higher than before the ’08 Financial Crisis! And the rising Dollar is making that debt much harder to service for these EM/FM companies. Any additional strength in the US Dollar is going to drain additional cash from emerging and frontier market companies as they struggle to service that debt.

And so we cannot afford to view the US in a tunnel. Looking only at US employment and inflation data and saying “ok let’s do this” would be narrow minded in today’s interconnected global economy. We should also consider the potential impact outside of the US. We kinda owe it to the rest of the world to do so. Like it or not… we have that responsibility as the world’s largest economy AND as custodian of its global reserve currency.

But if we want to be selfish and look past the effect that a continuing rise in the Dollar would have… we should at least consider that any contagion to equity markets might come right back around and punch us in the face. Remember “the wealth effect” that rising stock markets have on consumer spending? The US economy is 70% consumption. A broader and/or prolonged stock market correction might spook investors enough to actually impact consumers in the US. Nothing makes the wealthy and “middle class” in the US put off that purchase of a washing machine, car, or new home like 401(k) and brokerage statements showing red.

And so for that, and many other reasons, I believe the Federal Reserve would be making a mistake to hike interest rates.

But they will anyway. Probably sooner rather than later.

Even if the Fed passes on a rate hike in September and delays until the December meeting,8 the Fed has made it clear that 0% is coming to an end and they want to raise. Higher rates are in our future.

But if the Fed hikes now (or soon) – when many believe that they should be waiting – they won’t be the first central bank to have hiked “too early.”

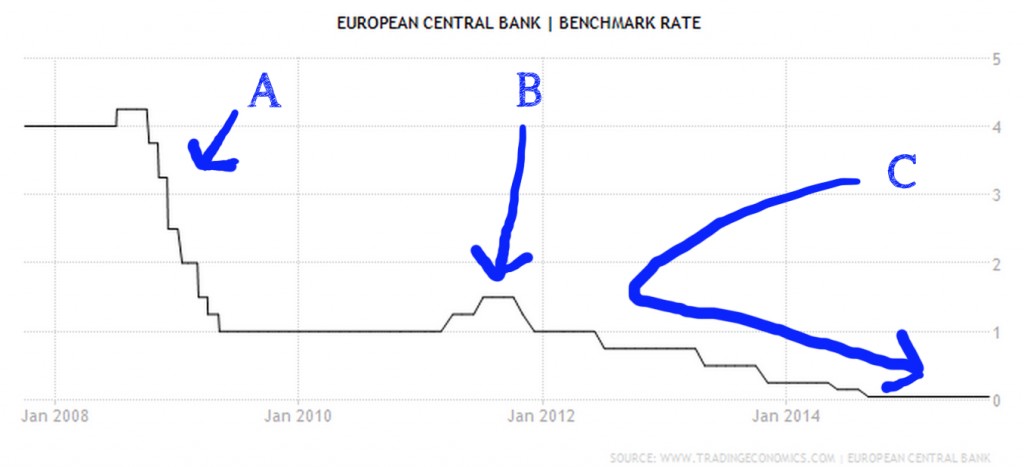

In 2011, despite Europe’s stagnant economy and a lack of inflation, under pressure from the every-fearful-of-inflation Germans, the European Central Bank (“ECB”) shifted straight into ludicrous mode and hiked rates not once… but twice.

Fortunately for Europe, once Mario Draghi replaced Jean Claude Trichet as chief, the ECB immediately reversed course and lowered rates:9

A: ECB drops rates to 1% because of the Financial Crisis. Ok, no problem.

B: ECB under Trichet raises rates to 1.25% then to 1.5%. Because, well… Germany.

C: ECB under Draghi realizes that Europe is still screwed and goes all Bernanke on rates, taking them to 0%.

So. If the Fed raises rates, kills the economic recovery, and then needs to lower them again quickly… there is a precedent. They can say the ECB did it first.

Or. They can say that they did it first. Way before.10

Remember 1997-1998? A little thing called the Asian Financial Crisis? Well, I won’t recap it all here,11 but the short story, as it relates to this post, is that things go so bad that then Fed Chief Alan Greenspan had to cut rates not once, but twice in 1998.

Most importantly, in doing Greenspan stated the following:

“It is just not credible that the United States can remain an oasis of prosperity.”

Doesn’t that sound like it could have been said today??? An investor need only to look around us… Europe and Japan have indicated no end in sight for their easing programs due to the fragility of the global recovery. And China in addition to the emerging and frontier market universe – is getting hammered. Need a specific example?

Just take a look at the following charts of the US Dollar versus the Malaysian Ringgit and the Indonesian Rupiah, respectively. Check out the meteoric rise in the Dollar since QE ended in 2014:

Kuala Lumpur. We have a problem.

Jakarta. You have a problem too.

Currency movements like that should take a decade to occur. Not months.

I could show you a lot more charts of EM/FM currencies that are just getting destroyed. But I don’t think I need to.12

Now… to be clear… I am NOT suggesting we are looking at a repeat of the ’97-98 Asian Financial Crisis. The macro picture today – while it sounds eerily similar with recent headlines such as “Ringgit Falls to New 1998 Low” floating around out there – is still different. But there is one similarity. All of the commentary is so US-only focused.

Well, as we described above… in 1997 and early 1998 we didn’t want to pay attention to the issues pressing emerging markets either. It wasn’t until the Dow had a couple of 500+ point drops that the Fed came around. And it would serve us well to remember Greenspan’s statement from when they did cut, which I’ll repeat here:

“It is just not credible that the United States can remain an oasis of prosperity.”

We are not alone in this. If Europe and Japan still need to ease to drive a recovery, China feels the need to devalue, and currencies across the EM/FM universe are plunging… how long do investors really think the US markets can remain immune?

Where we go from here.

So, all my Fed-talk and ranting has led to this. The Federal Reserve clearly wants to be done with the zero percent experiment. Fine. We get it.

But what does that mean for the markets? Well. The catch is unfortunately that no one can be sure. Because we are headed into new territory here. The greatest globally-coordinated money printing project in history is coming to an end.

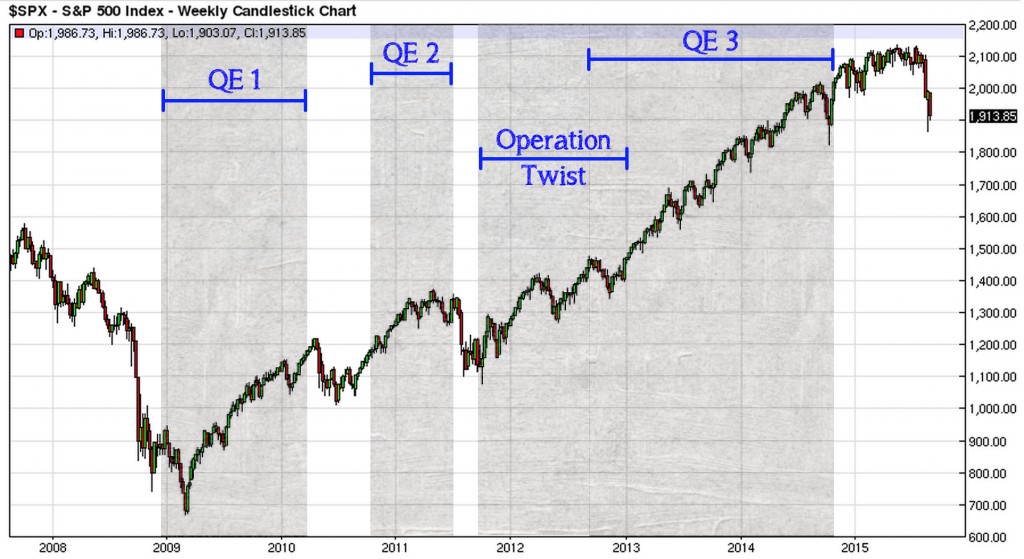

To put the post-financial-crisis period in perspective… I’ve taken a multi-year chart of the S&P500 and overlaid the periods of QE, as follows:

What can we learn from this? The only official breaks we’ve had in QE periods were 2010 and 2011, and both times the markets sold off until the Fed announced the next batch of kool-aid program of quantitative easing.

So as the above chart shows… for almost all of this recovery in the US markets, we have had some form of US Fed QE in place. And now we will not. Which I think is a big deal.

This will be a very interesting test. With no more QE and the first rate hike in September October December somewhere on the horizon… what happens next?

The “easy money” has probably been made.

In the absence of further easing by the US, it is quite possible that the easy money has already been made. The days of just throwing your capital into any market or financial product and watching it rise were great, but they were a departure from the norm. Because, well, it is supposed to be harder than that. And it likely will be again.

That being said, a “sideways” market – or even a down market – for a few years won’t be the end of the world. It will just be the end of the really easy money. In a more challenging market, there are still plenty of opportunities for investors to profit, but it often falls to the traders and the “stock pickers” to do so.

You see… in a flat or down market, “indexers” have a much more difficult time. If the S&P moves sideways for a few years, then obviously that cheap low-fee index ETF will as well. However, under the surface there will be plenty of volatility in which traders can profit. Disciplined traders who properly manage risk will be able to move in and out of position in this market to generate profits – on both the long and short side.

Additionally, value investors and other diligent “stock pickers” will find plenty of opportunities. Just because the broader market is flat doesn’t mean that a talented analyst can’t find mispriced stocks (or bonds or commodities or currencies). For years now actively managed mutual funds have seen net outflows as investor capital headed for lower-fee index funds and ETFs. This is the chance for those managers to prove that they can add value by locating opportunity in a market that – on the surface – goes nowhere.

And we aim to be in both camps. In this new post-easing world that we see ahead of us… we will look for opportunity both by carefully trading in and out of certain positions where we see a clearly defined risk/reward profile,13 and by building longer-term positions in securities which we believe are unfairly beaten down and attractively valued.

Patiently waiting. Still.

So while we wait and examine 1) what the Fed will do next and 2) its impact on the markets, we are still largely sitting on the sidelines. For some markets – mainly the FX market – the carnage has been so severe in certain places that we’ve already entered the fray… buying currencies that we see as “too beaten down,” as I wrote about here.14

For the equity markets, we have become buyers in certain markets (such as Mexico and Colombia) but for others (such as Malaysia and Indonesia) we are waiting and watching. But will likely become buyers at some point in the future should these markets come under additional pressure.

Perhaps in the short run, given our US Dollar exposure I am more focused on the Fed than others, but despite following the daily Fed “rumor-mill” we are still closely monitoring the “big picture” as well. Because in the end it does not matter whether the Fed chooses September, October, or December for a hike of 10, 25, or even 50 basis points. A Fed Funds rate of 1% or 2% is still accommodative policy.

What matters is that the theme of easy money that has dominated the markets for almost seven years is ending. And that’s ok. It’ll just be a little more challenging to find opportunities to profit.

But they still exist. And we will talk about more of them in future posts.

Thanks for reading,

Christopher

Position Disclosures: at the time of writing short USD and long EUR, NOK, SEK, HUF, both in BGIP and in personal retirement accounts. Long Mexico (EWW) and Colombia (GXG) in personal accounts.

The BackpackInvesting.com & BGIP Disclaimer

All market commentary and any other financial references featured on BackpackInvesting.com represent the opinion of the author and are not be construed as investment or trading advice. Such articles and commentary are not meant to be a solicitation or recommendation to buy, sell, or hold any securities mentioned. In the event that the author has an interest in any security, currency, or other financial instrument or product mentioned, that position will be disclosed at the time of writing, both for the accounts of Brentwood Global Investment Partners, LP (“BGIP”) and for the author’s personal accounts.

These little boxes are where I try to explain something in more detail in case it’s new to the reader. Other times I’ll just try to make a funny comment. You’ll just have to click to know which… ↩

Simple enough, right? Moving on. ↩

For anyone who’s every cared what is behind that headline you probably see on the news of “US adds X jobs in X month,” here’s the full report from Sep 4th. ↩

I talked about many of them in Part 1 of my The Effects of FX post. ↩

Because a little inflation is actually a good thing and can be managed properly. Deflation is a much bigger risk. ↩

just kidding obviously. If you are not a Fed data nerd like me… you deserve a little humor in this otherwise Fed-heavy post.

↩

↩…like it did during the 2013 “taper tantrum”↩

the Fed meets in October, but there is no press conference scheduled, so it is widely believed they would not raise rates in a policy statement without having a Q&A scheduled. Which I find stupid. They can always add a press conference at any point, and – I believe – should always have one after a meeting so that some meetings are not “more important” than others. But I digress…. ↩

after realizing how insane the move higher was to begin with! ↩

…begin random history lesson. ↩

…but those interested can read a great recap here. ↩

…because we are friends and you trust me, right? ↩

with a focus on risk management over profit… ↩

We’ve since also bought Hungarian Forint against the Dollar as well… ↩