In Part One of our Drilling for Ideas series we discussed the causes behind the past year’s plunge in oil prices. In Part Two we discussed the catalysts that we believe are needed to reach a bottom in the oil market and painted a picture of what the bottom of oil might look like.

The future for oil, as we envision it, is not likely to be a sharp V-shaped recovery and a race back to $100. Our scenario, rather, is for a slow and gradual recovery. Any increases in price are likely to be met by increased supply from idled US onshore capacity, which will serve as headwinds to oil price gains for some time. 1<- – – Click this little footnote.

But we cannot stop there. Developing a hypothesis of the future is only one part. Now we need to best decide how to profit should our scenario play out.

So here goes.

Theme 1: We want to own the equities of the strongest players…

Let’s start with the obvious. There is no way that I’m going to catch the exact bottom on the oil trade. But for our first theme… we do not have to. We are not trying to quickly trade in and out of this theme. After all, I expect a slow and gradual rise in oil prices… so this will be a slow trade.

So while I cannot possibly predict exactly when oil will bottom, I am confident that with some longer-term capital – let’s say at least three to five years – there are some definite value plays out there.

But as we discussed in Part Two… before we see the bottom and move on to the recovery there is likely another default wave coming that will result in more consolidation in the US onshore oil industry. So we don’t want to own the equities with any risk of insolvency during that time.2 We want to own those with strong balance sheets who are more than capable of riding out the storm. The ones that will emerge stronger in a smaller and more efficient US oil industry.

I’m sure there are some great small- and mid-cap companies out there with sound balance sheets, but I’ve started by looking first at only the big guys: the large and mega-cap companies with more than enough cash and credit to survive whatever downturn remains.

Exxon Mobile Corporation.

The first that I liked – and it is far and away my favorite pick across the oil space – is Exxon (ticker XOM). Like just about everyone else in the sector… XOM has been beat up the past year and is down about 25% from its 52 week high:

XOM is currently trading at about 17x forward earnings and the current dividend yield is 4%. This is one name that we hope to own for the long run to ride out the full, eventual, recovery in oil. While I have no illusion of this racing back to last years highs in the next year, I do believe that we’ll see $100 again in the next 3-5 years. In the meantime… while awaiting the bottom in oil I am happy to sit back and collect the dividend as a reward for patiently holding this true blue-chip name.

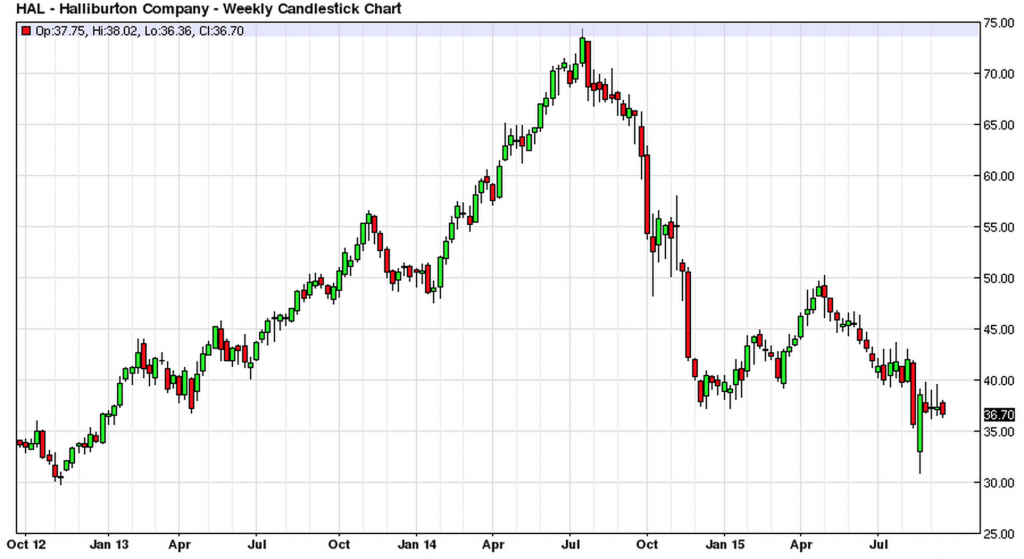

Halliburton Co.

Halliburton (ticker HAL) has also been beaten down with the rest of the energy sector and is currently trading 45% below its 52 week high:

HAL is currently trading at 20x forward earnings and yields just under 2%. Like XOM, we hope to be in this name for several years; this is unlikely to be a quick trade. And like XOM, while I cannot be certain if the bottom is in for this name, as it is a longer term play I do believe the downside to be relatively limited but am looking for a 25-50% gain over the next three to five years.

As a side note, it was a close call between HAL and larger rival Schlumberger Ltd (ticker SLB)… which I also like and find attractively valued. Unlike HAL, about half of SLB’s revenue is generated outside the US, insulating them a bit more from the current US downturn, however it was the pending HAL merger with Baker Hughes (ticker BHI) that led me towards HAL over SLB. Should the merger prove successful, it will strengthen HAL’s position both domestically and internationally. That said… should we want to add to this theme I might start a position in SLB rather than adding to HAL.

Other TBD Mid- and Small-Caps.

While I started with two of the largest players, I plan to continue to research the oil sector further and might add another name or two. The criteria would of course be similar… strong balance sheets, preferably a respectable dividend yield, and the ability to compete – and gain – from a smaller and more efficient US oil industry.

Theme 2: …and we want to sell calls against them.

This idea piggybacks on our first theme where we want to own the strongest players in the oil space to play a gradual recovery in oil prices. And the key word there… is gradual. If we do not expect oil to race back to $100… we shouldn’t expect the prices of these equities to race back to the ’14 highs either. We shall need to be the tortoise and not the hare in this contest.

In this environment, should we prove correct that the oil recovery will be gradual, I see a great opportunity to sell upside calls against our equity positions to generate an additional income stream. We have already sold calls against our XOM and HAL positions, and would likely do the same for any additional oil and gas names that we add.

Theme 3: We’ll buy the oil currencies. (Again.)

Several weeks ago we initiated a long position in the Norwegian Krone against the US Dollar as a way to play a slow and steady recovery in oil. At the time, the recent lows in NOK had held and I liked the risk/reward profile of buying the NOK in that range.

And… then the Norges bank caught the market – and me – off guard last Friday with a rate cut. It wasn’t the cut that mattered, but rather the dovish tone and comments that further cuts might be needed. The NOK gapped higher through 8.4 on the news and that was enough to force me to the sidelines. I closed out the position at a loss and will live the fight another day. 3

But we are not gone for good. We shall return!4 I still like the idea of owning one or more of the “oil” currencies once I have more conviction that the bottom is in. The NOK, Canadian Dollar (CAD), and Mexican Peso (MXN) are my top picks at this point.5

I suspect that when the time is right to return to this trade… the risk/reward will be similar to what I previously believed that I had in the NOK – a reward of 5x or possibly even 10x our risk.

Here is a longer-term monthly chart of each of the three pairs as an example to show the type of setup we are searching for (click to open, scroll through, then the little “x” top left to exit):

In each case above, we are looking for a point to “trade against” where we can risk a defined amount (i.e. 0.25% to 0.5% of equity) for a much larger profit potential (i.e. 2% to 4% or more of equity). I’ve marked what a hypothetical entry point and risk might look like with “A” on each chart. As you can see, there is a lot of “air” under these points that gives us a large potential reward for our risk (at point “B” on each chart).

For example… should the Peso manage to hold 17.5 to the Dollar and look like the trend is changing, we might buy the Peso against 18ish for a longer term objective of 15 or lower. On a much longer timeline – perhaps up to five years – I do not put a return to 13 out of the question and think this could be a great trade. But first the Peso needs to stop falling.

So in the short run… we’ll sit tight and be content to follow these closely.6

Theme 4: The macro winners & losers.

Now that we have looked at a few very specific trades to play our theme of a long and slow oil price recovery, let’s examine the highest level macro environment under that scenario.

I will not spend too much time on this as the case is quite simple. If oil is not going to return to $100 anytime soon…. Who are the winners?

The answer clearly is anyone who is a net importer of oil. This means mega-economies such as China, Japan, India, and almost all Europe. And low oil prices will be a tremendous tailwind for many of the EM and FM economies as well: most of the Central and Latin America countries, the non-petro Middle East (i.e. Egypt, Jordan, etc.), Africa other than Nigeria and Angola, much of emerging South Eastern Asia (i.e. Indonesia and the Philippines)… etc.

But if low oil prices will remain a tailwind for the importers, then by default this is going to continue to make life rough for the exporters – especially those for which oil is their economy. The petro-governments of the Middle East (Saudi Arabia, Qatar, Kuwait, etc), Nigeria, Angola, Colombia and bigger players such as Brazil. Oh yeah, and Canada.7

So that is the highest level for this trade – the countries who import and export oil. But the same theme can be applied a level below as well. Industries and companies for which oil is a significant cost will benefit from this slow recovery. The airlines are of course an easy example as fuel is their largest single expenditure,8 but as further examples two other industries that are inversely correlated to the price of oil are the automobile manufacturers9 and the aluminum industry.10 11

And we should also think of companies that indirectly benefit. For example Walmart and Costco (and other mega-retailers) gain from low fuel prices for two reasons: 1) as their truck fleets move product across the US the cost of logistics falls and 2) more obviously… their customers have more cash in hand to spend. Because discretionary spending really really 12 matters.

Speaking of which…

Theme 5: The consumer also wins.

The last – and potentially the biggest – winner in the scenario we have laid out in this oil series is the consumer. Low oil prices put extra cash directly into the hands of the consumer, and as such a world of slow and gradually increasing oil prices should benefit global consumer spending. This will of course help in the US, but it is even more important in other countries (such as India) where fuel (both heating and transportation) can account for a significant percentage of consumer budgets.

So while we are not jumping right into any specific consumer names today, the consumer discretionary sector will definitely benefit should our scenario of a slow oil price recovery materialize. As such we will factor that theme into any decisions we made at the micro level. I have already been running some stock screens for new ideas and have started the process of building more general “watch list,” so there will likely be several consumer discretionary names on that list.13

Summing it all up.

Let’s leave things there for now. While I have (hopefully) explained my thoughts on where oil goes next and laid out a few trades we’ve already placed and are currently stalking… the overall theme of a recovery in oil prices will be a major macro-economic factor that will affect many areas of the global investment landscape.

We will be watching closely to see if the scenarios I’ve laid out in this series play out, and will of course be ready to adjust should they not.

Thanks for reading,

Christopher

Position Disclosures: long XOM and HAL; short XOM calls and HAL calls.

The BackpackInvesting.com & BGIP Disclaimer

All market commentary and any other financial references featured on BackpackInvesting.com represent the opinion of the author and are not be construed as investment or trading advice. Such articles and commentary are not meant to be a solicitation or recommendation to buy, sell, or hold any securities mentioned. In the event that the author has an interest in any security, currency, or other financial instrument or product mentioned, that position will be disclosed at the time of writing, both for the accounts of Brentwood Global Investment Partners, LP (“BGIP”) and for the author’s personal accounts.

These little boxes are where I try to explain something in more detail in case it’s new to the reader. Other times I’ll just try to make a funny comment. You’ll just have to click to know which… ↩

…obviously. ↩

…however, I am glad to have done so, as the NOK continues to trade lower versus the Dollar and Euro at the time of writing. ↩

mwa ha ha ha (ha ha) ↩

Yeah yeah, there is also the Russian Rubble (RUB), but for the geopolitical risk and a few other reasons that will be addressed in an upcoming Russia post, I’m staying away from that one. ↩

As an additional side note, the Mexican Peso isn’t just an oil trade. Oil is a smaller percent of government revenue than some other petro-nations, so there are other macro issues with Mexico that we’ll have to examine as well.↩

Eh? ↩

…and just an example. I won’t be buying airlines though; that trade was last year. ↩

consumers buy more cars when gas prices are cheap and they have more cash in hand for discretionary spending ↩

the production of aluminum uses a tremendous amount of fuel ↩

also the aluminum industry will be under pressure from the “global growth is slowing and China is imploding” camp so we are only watching this for now. ↩

really ↩

…which we shall most likely share in a future blog post. ↩

Comments 3

That was awesome! Read all three parts as soon as I got into the office. I REALLY wish I could do more trading off of stuff like this, and spend more time researching it instead of just having to write about the fluctuations of the stock market. Also, the currency charts hit me with a huge wave of nostalgia. I miss trading currencies, but just don’t have time to follow it closely enough. Some day, though.

Chris, great analysis in all three posts. I had decided to re-read the series in light of continued oil market malaise and had a follow-up question for you, now that it’s been a few months since you originally posted this. In Part III, you had mentioned that small- and mid-cap names were TBD. Given oil’s precipitous decline (i.e. $44 to $28) during the past few months, are you still content to sit on the sidelines until we get closer to a bottom, or are you pondering diving in? And if the latter, do you lean toward takeout targets (who may be distressed and in need of a buyer, but possess quality assets such as large swaths of contiguous acreage, producing wells, solid reserve base, etc) or toward the financially healthy who you believe have the wherewithal to stay the course?

Thanks again for the great posts and for laying everything out so clearly and succinctly. I’ve recommended your blog to many of my non-finance friends!

Author

Hi Jen. I’ve given this post a lot of thought with the slide from $40 to $30. As of now I’m not buying any more (have a large position in both XOM and HAL), but part of that is lack of time to do any micro level analysis due to a combination of other trades I’m working on and travel time issues right now. I’m sure that there are some great small cap names and I wish I could look through them to pick a few. I have considered just adding more XOM or one of the servicer ETFs, but hanging on for now.

As for “takeout targets” versus the healthy ones… my initial opinion is that I would stick to the healthy ones. Without giving it more than a second of thought… I also suspect those could actually be the better takeout targets. If a target with a good asset base is highly leveraged and in trouble (or has a high risk of default), then a lot of buyers might wait to acquire in a Chapter 11 (or buy the debt at a big discount rather than pay the premium for a normal acquisition), so I’d probably err toward health over something trading at a distressed level.

Great comment – thanks!