In Part One of our Drilling for Ideas series, we examined the now year-old price decline in oil, concluding that the cause was an oversupply problem, purposefully orchestrated by a Saudi-led OPEC to regain market share and bankrupt the US tight oil industry. The gamble being made by the Saudis is that they can ride out the low price of oil long enough to make their competitors fold. Then… with that extra US supply off the market, prices will stabilize and rise, returning to the good ole days for the OPEC countries. 1<- – – Click this little footnote.

For the past twelve months or so, that strategy appears to be working. But now we need to leave the present to try to think ahead to what comes next. As a macro investor… my job is to imagine a world that is different than the one in which we are currently operating. To try and explore the catalysts that will cause a change from the status quo and to position ourselves – and our capital – accordingly.

So in Part Two of this series, I’d like to examine the two catalysts that I believe are likely to occur next in the oil industry.

Catalyst 1: The Saudi gamble proves too costly.

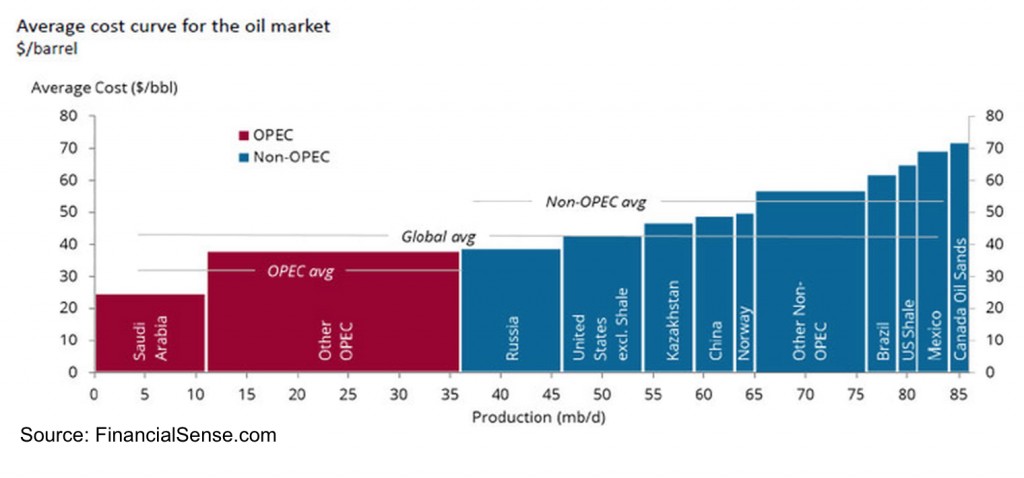

This little price war obviously isn’t free for the Saudis; it is actually costing them quite a lot of money. Now, one point that I often hear thrown around when discussing the oil markets is that the Saudis do not care about $40 oil because they produce oil so cheaply. This is only partially true. The Saudis do not release official production cost data, but estimates place their marginal cost of production anywhere between $10 and $25 per barrel. It is however widely accepted that the Saudis have the lowest marginal cost of production on the block. This little chart gives a pretty good picture of the cost landscape:

So whether it costs $10 or $20 to pull a barrel of oil from Saudi soil, it does cost everyone else more. And while it might appear that the Saudis can still profit at $40 oil… this is only half of the story.

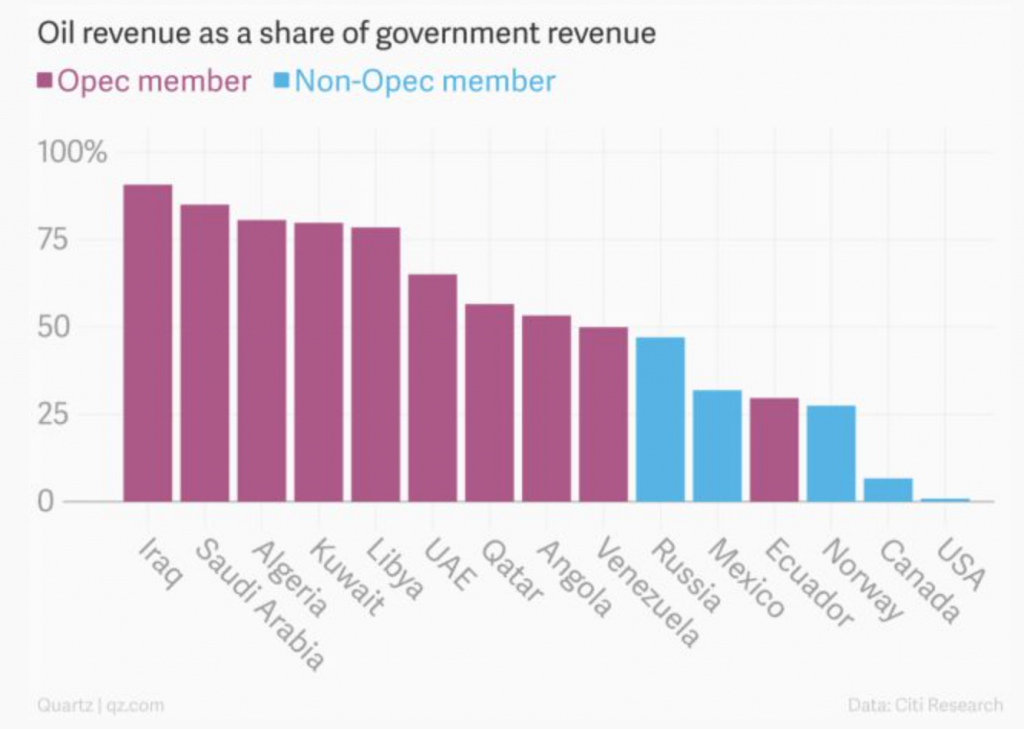

The other side of the cost equation that must be factored in is not the country’s marginal cost of oil… but the budget breakeven cost. All of the major oil producers depend on oil revenue for a significant part of their government revenue, as this handy little chart from qz.com shows:

The Saudis depend on oil for over 80% of government revenues. Why is that you may ask? Well… the Saudi Royal Family, for lack of a better way to say it, dishes out lavish subsidies to its people in order to maintain a grip on power and to prevent the type of social unrest that led to a wave of overthrown governments during what we now call the “Arab Spring.” Saudi citizens pay no income tax (or tax on interest, dividends, etc). They receive free education. They also receive free healthcare. And gasoline is kept around $0.50 per gallon.

Still don’t believe that is “buying” control and power? Try this. Earlier this year when Saudi King Salman bin Abdulaziz Al Saud assumed the throne after the death of King Abdullah, he paid a two month bonus to all state employees, soldiers, students, and pensioners. Which analysts estimate cost the government as much as $30 billion.2

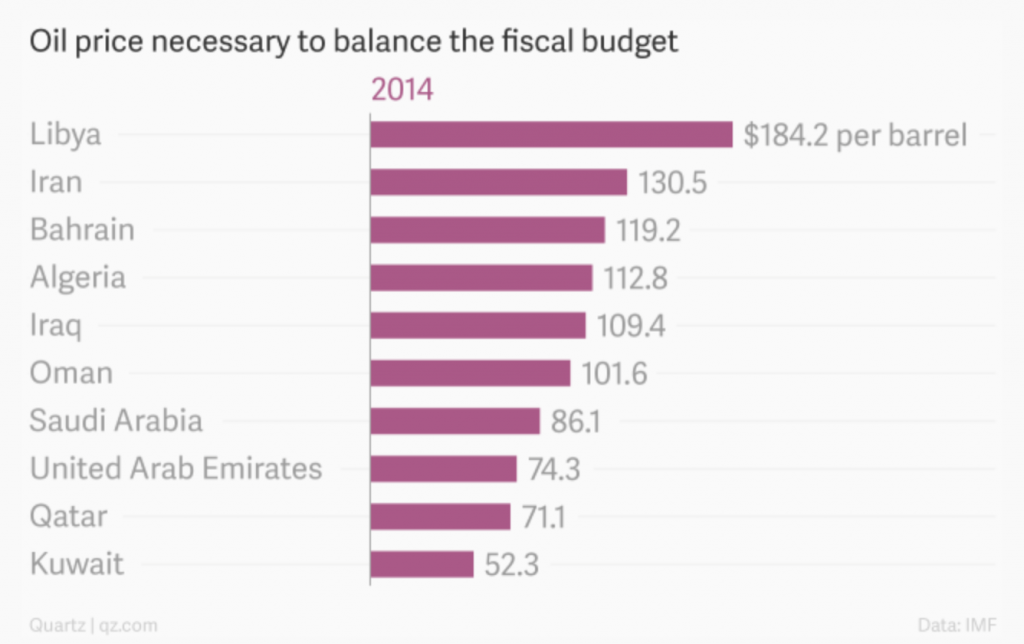

And so while the Saudis might be on the absolute low end of scale at marginal production cost… when you factor in the Saudi government budget and all of this subsidy spending, they are at the other end of the scale when looking at budgetary break even (chart from qz.com):

So QZ says the Saudis need $86 to break even. Other estimates place the break-even point as high as $106 for the 2015 Saudi budget. Whether budgetary break even is $86 or $106, it doesn’t matter if the Saudis can pull oil from the ground at $1 per barrel at the marginal rate. As long as the Saudi Royal Family is dependent on dolling out cash to keep the peace… they too need high oil prices.

So what, exactly, are the current low prices doing to the Saudis then?

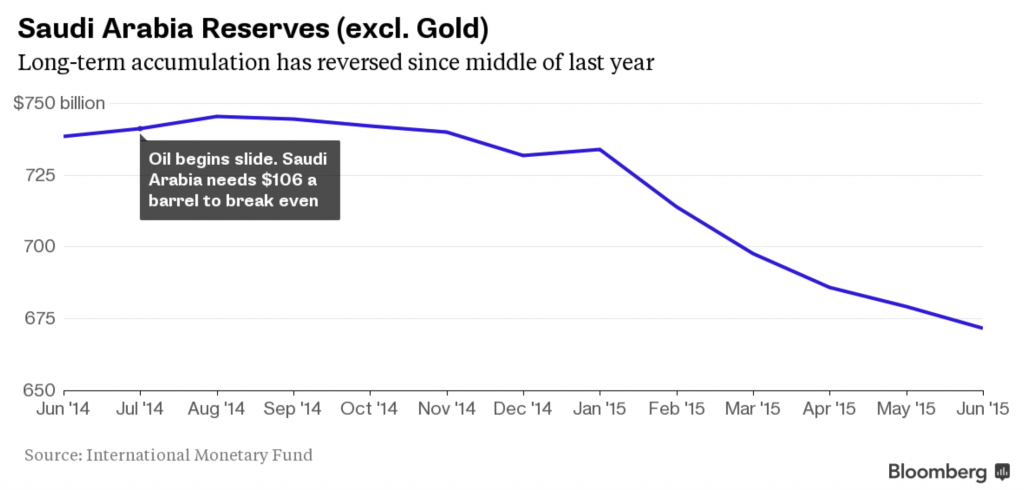

Well. On one hand, to plug the current budget deficit the Saudis had to 1) issue bonds for the first time in 8 years and 2) are burning through their reserves, which according to Bloomberg have dropped by almost $76 billion or 9% since this little price war began:

Now, sure, the Kingdom still has $675 billion to play with… but they are not going to run that to $0. The markets have already taken note and, well, the feedback has not been positive. Saudi Arabia is already being forced to cut government expenditures to avoid a credit downgrade, and as we discussed above, they need those subsidies to keep the people happy.

So. While it is financially possible that the Saudis could lean on OPEC for a few more years to keep the price war going… I do not believe they can afford to wait that long. Possible and practical are two different things. To continue the price war, the Saudis must issue more bonds, continue to burn reserves, or make further cuts to the generous government subsidy tap. Or possibly a combination of all three. None of those is appealing, so my belief is that sometime in late 2015 or early 2016 we will start to hear chatter about an OPEC production cut designed to raise oil prices.

But it will not just be the cost of the Saudi gamble that will cause the price war to end. The other reason that the Saudis will end up abandoning this strategy is that in the end… they will realize that their strategy will ultimately fail. Because their plan is about to backfire.

Catalyst 2: The American oil industry consolidates.

As we discussed in Part One of this series… if the Saudi plan was to bankrupt the US tight oil industry, it might seem like the dozen or so credit defaults that have occurred and the recent increase in bankruptcies in the sector would indicate that their plan is working.

And now things are, unfortunately, probably going to get a bit worse before they get better.

The primary reason that we have not seen more bankruptcies since oil started falling last summer is that many of these small upstart firms were well hedged from last year. As many had oil locked in upwards of $80 or $90 per barrel… the effects of the initial decline were limited. But most of that protection has now expired (or is expiring). And so when those hedges expire – and many already have – those firms are now exposed to the new lower oil price. The effect will be severe; in the absence of these $80+ hedges… many producers in the onshore oil industry will not have the cash to meet required debt service and will default.

The situation was already grim before the hedges expired. A new report from the EIA last week stated that:

“83% of the operating cash at U.S. companies with onshore activity was devoted to debt repayments from July 1, 2014 to June 30, 2015, marking the highest rate since at least 2012.”

That is a really big deal. If these firms are already spending 83% of cash to service debt… there is no room for error. And so the trend of defaults and bankruptcy filings is likely to accelerate before it ends.

But the goal of the price war was not only to put these firms out of business; it was also to regain market share. That too appears to be working. US oil production peaked months ago and has already started to fall as many of the less profitable projects and less efficient fields have been idled.

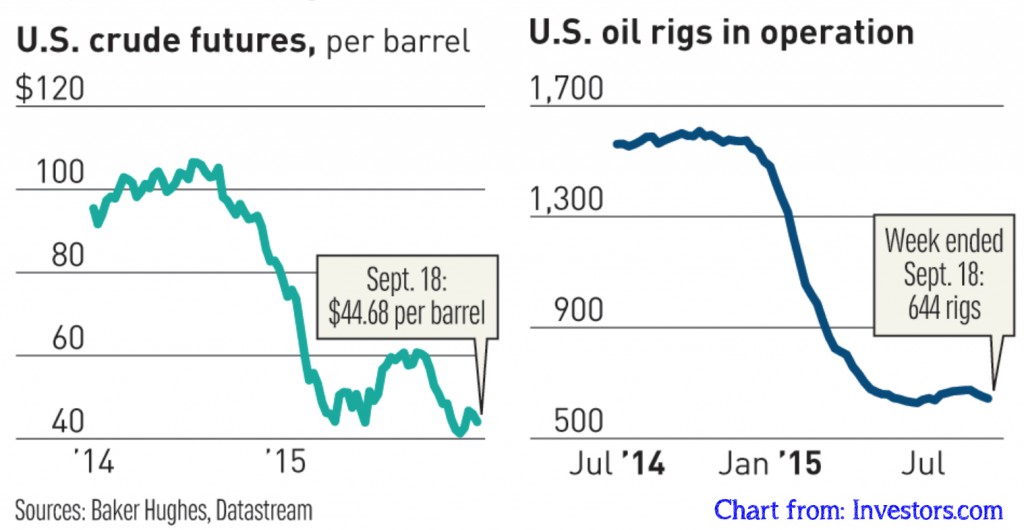

As this chart from Investors Business Daily shows, as the price of oil has fallen… the number of rigs in operation has plunged as well:

So wait. If we have already seen a series of defaults and bankruptcies with more to come – and if US production peaked and is falling… then why can’t we say the Saudis have won? Isn’t that exactly what OPEC wanted?

Well, to declare a victory would be shortsighted. Because while a wave of industry defaults might have been the Saudi/OPEC goal… unfortunately for them these bankruptcies will not be the end of the story.

You see… when these firms fail those wells are not going to just sit idle and dry up. The assets of the failed firms – including the leases, equipment, wells, staff, etc – are all but certain to be acquired at a discount by the bigger and stronger players in the space. The onshore oil producers and suppliers that have strong balance sheets and the ability to ride out this downturn are about to go shopping at a fire sale.

We are going to see more pain for the US tight oil industry, but there is a silver lining. I am firmly in the camp which believes that there is a wave of consolidation coming. While some might be through “friendly” mergers, others will be really nasty bankruptcies and restructurings. But in the end the result of this consolidation will be a nightmare for OPEC:

A smaller but much stronger and more efficient US oil industry will emerge.

What comes next?

So lets say that our two catalysts play out. The Saudis eventually abandon the price war. And along the way a wave of defaults and bankruptcies result in US onshore oil industry consolidation. Then what?

Our expectation is that when the supply imbalance does finally correct, the result will not be a race back to $100 oil. Far from it. It will be a slow and gradual rise in price. 3

The reason a smaller and stronger US oil industry will be a nightmare to OPEC is that the consolidated industry will be ready to increase production the second prices start to rise. All of that excess capacity that was contributing to the supply glut is not gone. It was just idled. While the rig count has declined in the US, those firms simply moved production to the most efficient locations and idled the rest.

If the Saudis abandon the price war via an OPEC production cut, that combined with the decline in US production in 2015 from idled operations will provide support to the oil market and cause prices to rise. But each dollar rise in the price of oil will encourage a producer in the US to bring online another idle well. All of the new capacity that has come online in the US from 2010 to 2015 is going to be an overhang to oil prices for some time.

The most likely scenario – based solely on my humble opinion of course – is that while we saw a $50 price drop in little more than half a year… it will take much longer to get that $50 back. In face, I expect that it will take several years just to get back to $80 oil. As I have tried to project in this fancy chart in blue:

So that’s my best guess. We get a bottom process later this year or in the first half of 2016 followed by a slow climb and NOT a “V shaped” race back to $100.

But as I stated in the introduction to this section, as a macro investor part of my job is to imagine a world that is different from today, which we’ve hopefully done above by examining the end of the Saudi gamble and the consolidation of US onshore oil production.

The second part of that job is a bit more interesting. That is where we get to try and determine how to profit in this different future that lies ahead of us.

Which we shall do in Part Three…

Thanks for reading,

Christopher

Position Disclosures: at the time of writing long XOM and HAL; short XOM calls and HAL calls.

The BackpackInvesting.com & BGIP Disclaimer

All market commentary and any other financial references featured on BackpackInvesting.com represent the opinion of the author and are not be construed as investment or trading advice. Such articles and commentary are not meant to be a solicitation or recommendation to buy, sell, or hold any securities mentioned. In the event that the author has an interest in any security, currency, or other financial instrument or product mentioned, that position will be disclosed at the time of writing, both for the accounts of Brentwood Global Investment Partners, LP (“BGIP”) and for the author’s personal accounts.

These little boxes are where I try to explain something in more detail in case it’s new to the reader. Other times I’ll just try to make a funny comment. You’ll just have to click to know which… ↩

…as covered further here and here and here for those interested. ↩

baring, of course, a major external geopolitical shock ↩