So in my prior post on China, I shared a few pics, videos, and thoughts on the random rows of apartment/condo towers that we saw, often in the middle of nowhere, on our train ride through Northern China, concluding that post with the following thought:

“China is like a shark. It must keep swimming or it will die. Except ‘swimming’ is really ‘building stuff.’ China needs to keep building things and making stuff or the economy will crash.”

So what exactly did I mean by that? To answer that question we will need to nerd-up this post a little 1 and take a look at China’s GDP .2<- – – Click this little footnote.

China Needs to Build to Survive

There is only one thing that the ruling Communist Party of China3 or “CPC” fears: angry Chinese. China does NOT want growth to slow to a level that it cannot take care its people. And to state the obvious… taking care of 1.4 billion people is a tough job, and it is certainly not without risk.

Imagine what we now call the “Arab Spring” spreading to China – hundreds of thousands of people protesting in the public squares and demanding jobs, reform, and generally just a better life. It is that scenario that keeps the CPC leadership up at night. And to prevent that type of social problem, they are determined to keep everyone happy. Which means employed. Which means creating jobs.

China’s growth over the past three decades is nothing short of an economic miracle. Sure, it’s been less than a smooth ride getting from the Great Leap Forward through the Cultural Revolution and onto today’s success story.4 But in the process, China has lifted half a billion people from poverty, created a middle class from scratch, and become a global economic juggernaut.

So how did that happen? Well, as hundreds of millions of Chinese moved from the old “centrally planned economy”5 to the modern one, the government needed to find jobs for everyone. It’s the basic “global growth” story you are most likely familiar with – Chinese citizens leaving small villages and local farming life for better opportunity in the cities, slowly winning manufacturing jobs away from the rest of the world through a combination of (very) hard work and cheap wages.

Because of this shift, China changed very rapidly during the 80s and 90s and continued that evolution into the early 2000s as, well, they started making much of the world’s stuff.6 This growth ensured that the government was meeting its goal of keeping everyone happy and employed.7 Much of that employment was in industrial manufacturing and production of goods for export, however this shift also fueled the construction boom that modernized China. All of that new manufacturing labor needed factories, the workers needed housing, the goods needed roads/rails/ports to get to market, and the citizens of these growing cities needed places to shop. And all of that construction resulted in a huge boost in China’s GDP growth, which was double digits for much of this time.

A Closer Look at China’s GDP

Let’s recap for a second what GDP actually is. Sure, at the surface economists will tell you that it is the way we measure the success and growth of an economy, but what is GDP? Well we can break it down into the following formula:

GDP = C + I + G + (X – N)

GDP = Household Consumption (C) + Investment in Fixed Assets (I) + Government Spending (G) + Exports (X) – Imports (N)

So the thing is… China’s really loves the “I” or “Investment” part of GDP. A lot. For most developed economies, “household consumption” far and away leads the pack as the largest component of GDP. But not in China’s case.

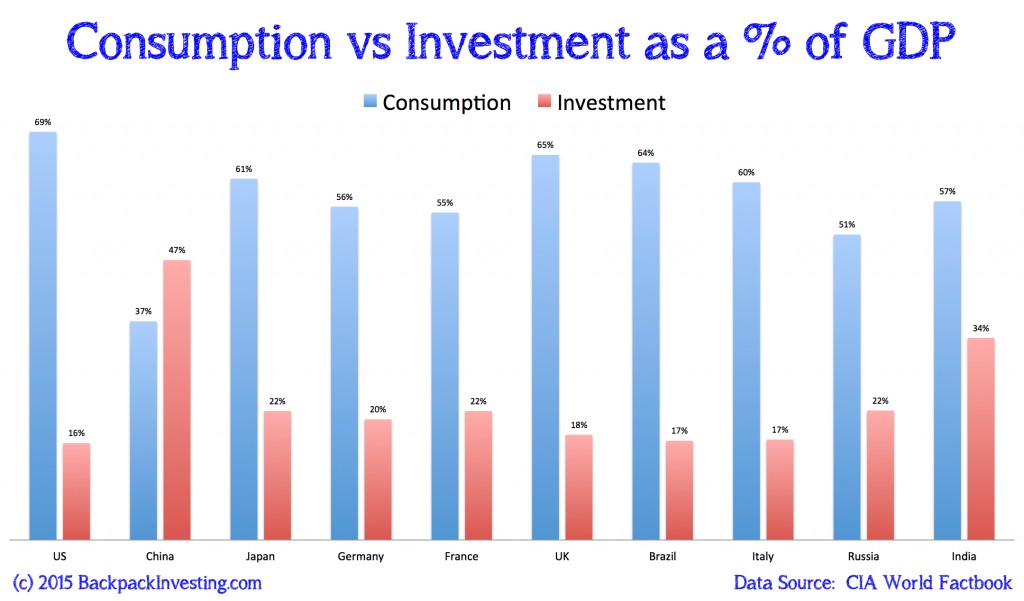

Here’s a quick chart I threw together comparing the Household Consumption and the Investment components as a percentage of GDP for the top 10 largest economies in the world:

As you can clearly see, household consumption dominates at > 50% of GDP for ever country except for China. In the other countries “Investment” is under 25% of GDP (with India being the exception at 34%). With China, however, these two are flipped. Household consumption is only 37% of GDP while investment is a whopping 47%!

And that is where all of those rows of apartments from my last post come back into play. That is where China is still a shark. They have to keep building. Everywhere.

Housing, factories, office buildings, highways, etc. If they do not, that component of GDP goes away, which means the jobs go away. And then you have the angry mobs in the street that we know the Chinese government so greatly fears.

Now, to pause for a second. If it sounds like I’m being very negative again or that this post is drifting into here’s another major problem with the world economy territory, well don’t worry. We are about to take a positive happy turn. Because there’s a pending shift in China that has the potential to be a MAJOR positive addition to the global economy.

You see, not only is the CPC aware that China is too dependent on manufacturing and construction, but so are the world’s major corporations. Nike, Apple, Walmart, KFC, and tons of others (including, of course, domestic Chinese companies) are salivating at the thought of Chinese consumers spending more. Because that ultra-low Household Consumption As A Percentage of GDP statistic that China is currently sporting… it is not because Chinese consumers don’t have the money. Oh no. The Chinese are absolute saving machines.

Why The “C” In China’s GDP Is So Low

Chinese consumers do not spend with the same reckless abandon as their western counterparts. They save. Ok… I’m generalizing a bit here, but it is true. The average Chinese citizen saves 30% of his/her income. Thirty. Percent.

That is much higher than their industrialized peers where that household savings number typically ranges from 0% to 6% of income. Granted as incomes have risen in China, Chinese consumers have in fact raised their spending in terms of total dollars spent, but they’ve raised their total saving even more so the saving as a percent of household income is actually going up. But why save so much? To understand why… we need to back up a bit for a history lesson.8

So let’s review the period from about 1966 to 1976. That was the whole “Cultural Revolution” time of Mao Zedong. “Chairman Mao” decided that the Soviet model of communism had jumped the shark and lost touch with it’s original socialist ideals, so he wanted China to do things differently. This decision came right on the heels of the terrible failure of “central planning” that took place on Mao’s watch during the Great Leap Forward.9

So to sum all that up, the Great Leap Forward and the Cultural Revolution was the period in China in which everything basically went to sh*t.10

During this period, officially the government was everything and took care of everyone. Or it was supposed to at least. Citizens/workers were organized into a type of commune that was supposed to efficiently manage agricultural and industrial production. But the entire process was a total, complete, and miserable failure.11

Mao closed schools and created a kind of “youth army” called the Red Guard that attacked – both verbally and physically – the elderly, intellectuals, and anyone seen as “bourgeois.” And of course under Mao’s brand of communism, you still didn’t own property, be that your home or the fields you worked. So on Mao’s watch, self-interest was gone, food was scarce, industrial production fell, life in general totally sucked, over 1.5 million people were killed, a few hundred million more were impoverished, and since this movement was generally concentrated in the cities where economy activity was centered… as you can expect the entire economy across China went into the dumps and stayed there for a decade as China retreated from the world stage.

But… that, of course, all took place before our boy Deng Xiaoping took power in ’77, shook things up, awoke the economic dragon, and oversaw the reforms that made China into what it is today. An amazing powerful GDP-creating machine.12

So… since Deng Xiaoping’s economic shift, the Chinese have basically been responsible for themselves. In addition to taking care of one’s self and one’s children, most Chinese were also responsible for any elderly parents that could not take care of themselves. There wasn’t a formal social security or medicare system, so that’s where the high saving and low spending trend comes from. That high personal savings rate developed out of necessity – it was a personal safety net and those savers deserve credit for taking responsibility for their future. The average Chinese citizen found it easy to save for a rainy day because, frankly, it wasn’t raining that long ago.13

Swapping The “I” For The “C” In GDP

So with that depressing history lesson behind us, here is where the opportunity comes into play. China’s high savings rate is a cultural fallout from decades of economic mismanagement and general mistrust in the system. The Chinese government is well aware that it’s “Consumption versus Investment” trend in GDP is out of whack with the other top economic dogs. And CPC leadership would love for that not to be the case.

But one cannot just flip a switch and make everyone spend more. It requires a cultural shift as well – for Chinese consumers to become secure with the government’s promises of a social safety net and with their own future economic and social stability.

Economists have been all over this potential shift in consumer spending for about a decade now. I attended an economic conference in Chicago about five years ago in which Goldman’s former Chief Economist Jim O’Neill14 called this shift the most important economic trend of the next 20 years. I’m just saying a lot of smart people are all over this, so I’m not pretending to be breaking news here.

I’m generally in the “China Bull” camp here, believing that China will eventually AND successfully make the shift to become an economy less dependent on manufacturing and investment in capacity and more in line with the other advanced economies where consumer spending on goods and services pushes the economy ahead. Said differently, I think China will be able to shift from “I” to “C” to keep it’s GDP growth rate up.

I really do believe China will get there – even more so after seeing Shanghai and the surrounding region a few years ago and Beijing and Xi’an on this trip. China just feels very exciting. Waking down the streets you see a hardworking culture that is about to turn the corner to do something amazing. I would imagine it felt the same way to be in New York or Boston a hundred years ago. There’s just a feeling that brighter days lie ahead for China.15

A Long and Bumpy Transition

With that little optimistic prediction behind me, I will admit that I do not believe the transition from “building” to “spending” will be easy for China and it definitely won’t be overnight.

As an excellent and very current example, just over the past two weeks the Chinese stock markets have been an absolute roller coaster, with the Shanghai Composite Index now down almost a third from its recent peak:

This sell-off told us something very important about the current mindset of the Chinese government. They are not yet ready to fully release the reins and let the market do it’s thing. Did the CPC step back and say “Hey investors… you did this to yourselves. You ran up the markets into stupid bubble territory and the P/E ratios were absurd, so this is the price you pay and now the market is letting valuations come back to reality?”

Of course they didn’t say this. They tried to contain the carnage. Because as we’ve stated several times the only thing they fear is angry mobs in the streets. So instead of letting the markets teach investors a lesson about what happens when a bubble corrects… they tried to stop the bubble from popping.

Here’s some not free-market things the Chinese Government did to “contain” a stock market crash:

1) halted trading in over 90% of shares listed

2) blocked new IPOs

3) capped short selling

4) pension funds agreed to buy more stocks

5) brokers created a fund to buy stocks… a fund that is back-stopped by the Chinese central bank

What this tells us is that the transition to truly freely floating markets is going to be slow. AND it is going to be controlled at all costs.

The same will apply to our little investment to consumption shift in GDP; the Chinese Government is going to be VERY careful about how and when any transition from investment to consumption occurs. They won’t risk backing off on the push to build “stuff” only to see the consumer not pick up the slack. That would mean a collapse in GDP. Which would mean going to that whole “angry mobs” place that China does not want to go.

Summing It All Up

It is going to be fascinating to watch this trend develop over the next decade.16 And it’s very much needed. The status quo of the past 20 years where the US buys everything and China makes everything is unsustainable.17 And, as wages rise in China, members of the new middle class have decided that they don’t want to make the rest of the world’s stuff; they want to buy the rest of the world’s stuff.

Which will be badly needed because someone is going to have to fill the very large shoes of the American consumer. That is a trend I like to call The Rise of the Global Consumer. It’s something I am VERY interested in and it is at the core of our research on this trip. It is the reason that Lauren and I have now toured malls in multiple cities in China, Indonesia, and Malaysia. Not so that we can buy things, but so that we can watch the rest of the world buy things.

I’m very excited about what The Rise of the Global Consumer will mean for the global economy. It should be very bullish and we’ll certainly be covering this topic in more detail in future posts.

Thanks for reading,

Christopher

ok, a lot…↩

These little boxes are where I try to explain something in more detail in case it’s new to the reader. Or… other times I’ll just try to make a funny comment.↩

Don’t let the name fool you; they are often better capitalists than we Americans ↩

Um. Serious understatement… see below↩

That’s economic speak for “Communist.”↩

There’s no need for me to dwell on this. You’ve all heard the story. Manufacturing left many other places and was outsourced to China because labor was cheap. Moving on…↩

Yay, CPC!↩

If you are reading this in bed after a long day or just woke up and haven’t had coffee yet, come back tomorrow or I’m going to go all “Bueller? Bueller?” on you and put you to sleep. Seriously.↩

…which, by the way, China should totally rename the Stupid Leap Backward. Seriously. Enough time has passed; we should call it like it it. Anyway.↩

Sorry; but it’s true. It was a total disaster.↩

I’d use more synonyms there if I could. It was that bad.↩

The 21st century is totally going to be China’s. Such a hardworking culture and they want it. Bad. They will get it. I truly believe that.↩

…not unlike how many of those who lived through the US’s Great Depression never forgot what it was like to worry about where your next meal might come from.↩

he’s the lad that coined the catchy phrase “the BRICs” for Brazil, Russia, India, and China. And yes I said “lad” because he is British.↩

I’m paraphrasing a great point often made in media appearances by investor Jim Rogers, author of my favorite.book.ever Adventure Capitalist.↩

or maybe two decades ↩

…because we are broke. Yeah, I said it.↩

Comments 5

Hey! I recognize that shirt…..

Also, I think this is a fantastic article. Can’t wait for the Rise of the Global Consumer.

Author

It was either a “made in China” pic from your Uniqlo shirt… or my boxers. The former won.

Great article. I feel like someone else needed to comment besides the two authors:)

A stimulating article…giving rise to the question: how will China’s plans/economy be affected by global opinion due to issues like cyber invasion and satellite/space policies, along with our debt ratio with them? It seems as though we US’ers view China with a mixed-bag attitude: 1) we like their cheaper product offer, while lamenting the job loss because of it.

So, for all the countries in the queue, the question may become, how the investor should rate the global startups as we all stab at predicting the future…for them and US.

Excellent article!